Report of the statutory auditor

PricewaterhouseCoopers AG

Birchstrasse 160

8050 Zurich

Telephone +41 58 792 44 00

Fax +41 58 792 44 10

www.pwc.ch

Report of the statutory auditor

to the General Meeting

Geberit AG

Rapperswil-Jona

Report on the audit of the consolidated financial statements

Opinion

We have audited the consolidated financial statements of the Geberit Group and its subsidiaries (the Group), which comprise the consolidated balance sheet as at 31 December 2016 and the consolidated income statement, consolidated statement of comprehensive income, consolidated statement of changes in equity and consolidated statement of cash flows for the year then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies.In our opinion, the accompanying consolidated financial statements give a true and fair view of the consolidated financial position of the Group as at 31 December 2016 and its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRS) and comply with Swiss law.

Basis for opinion

We conducted our audit in accordance with Swiss law, International Standards on Auditing (ISAs) and Swiss Auditing Standards. Our responsibilities under those provisions and standards are further described in the "Auditor’s responsibilities for the audit of the consolidated financial statements" section of our report.We are independent of the Group in accordance with the provisions of Swiss law and the requirements of the Swiss audit profession, as well as the IESBA Code of Ethics for Professional Accountants, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Our audit approach

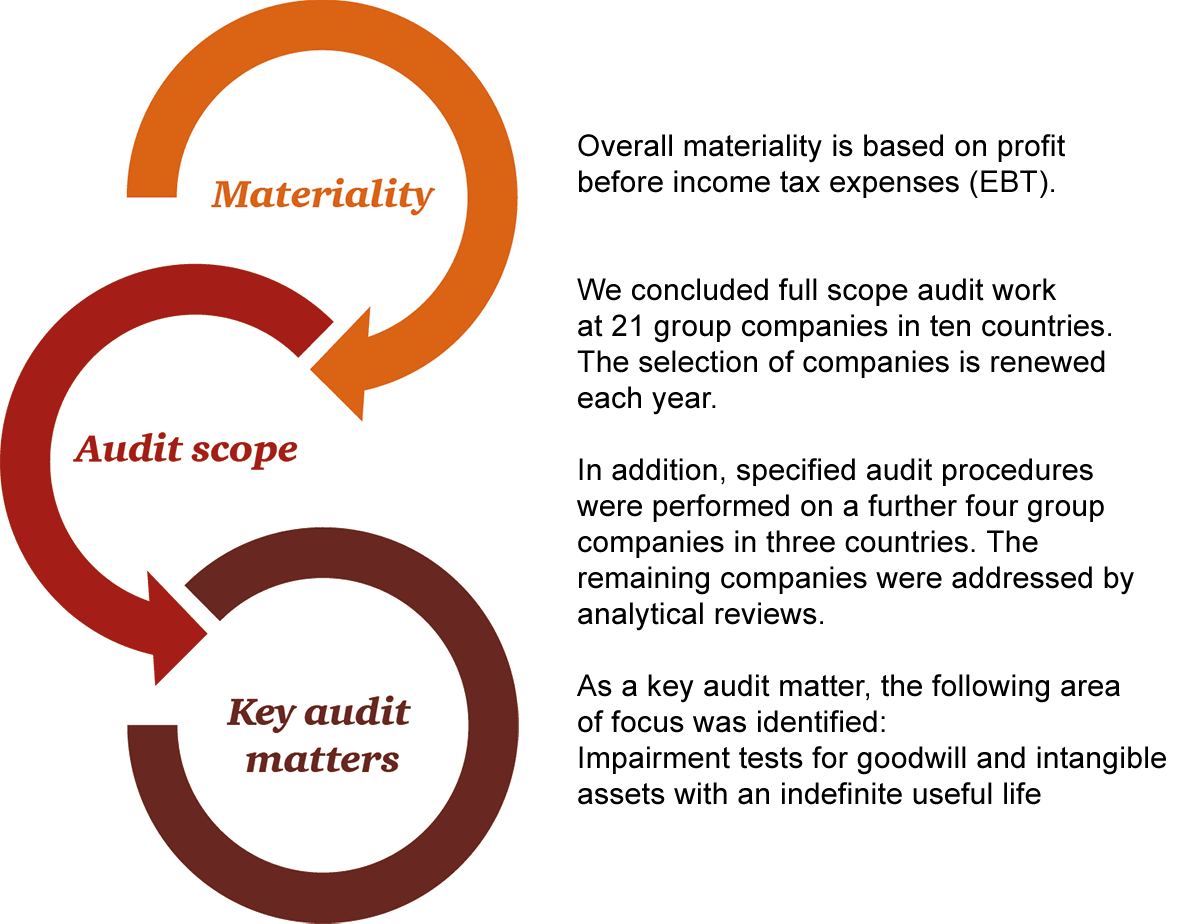

Overview

Audit scope

We designed our audit by determining materiality and assessing the risks of material misstatement in the consolidated financial statements. In particular, we considered where subjective judgements were made; for example, in respect of significant accounting estimates that involved making assumptions and considering future events that are inherently uncertain. As in all of our audits, we also addressed the risk of management override of internal controls, including among other matters consideration of whether there was evidence of bias that represented a risk of material misstatement due to fraud.We tailored the scope of our audit in order to perform sufficient work to enable us to provide an opinion on the consolidated financial statements as a whole, taking into account the structure of the Group, the accounting processes and controls, and the industry in which the Group operates.

Materiality

The scope of our audit was influenced by our application of materiality. Our audit opinion aims to provide reasonable assurance that the consolidated financial statements are free from material misstatement. Misstatements may arise due to fraud or error. They are considered material if individually or in aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of the consolidated financial statements.Based on our professional judgement, we determined certain quantitative thresholds for materiality, including the overall Group materiality for the consolidated financial statements as a whole. These, together with qualitative considerations, helped us to determine the scope of our audit and the nature, timing and extent of our audit procedures and to evaluate the effect of misstatements, both individually and in aggregate, on the consolidated financial statements as a whole. We chose profit before income tax expenses as the benchmark because, in our view, it is the benchmark against which the performance of the Group is most commonly measured, and it is a generally accepted benchmark.

Key audit matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the consolidated financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.Impairment tests for goodwill and intangible assets with an indefinite useful life

| Key audit matter | How our audit addressed the key audit matter |

|---|---|

| Impairment testing of goodwill and intangible assets with an indefinite useful life was deemed a key audit matter for the following two reasons. Goodwill and intangible assets with an indefinite useful life represent a significant amount on the balance sheet (goodwill of CHF 1,255.1 million and intangible assets with an indefinite useful life of CHF 316.0 million). These assets are not regularly amortised but tested for impairment at least annually. Moreover, in calculating the value-in-use for these tests, the Board of Directors and Management have significant scope for judgement in determining revenue and margin growth assumptions and the discount rates to be applied to the expected cash flows and in specifying the cash generating units (CGUs). With regard to the accounting policies and information on goodwill and intangible assets with an indefinite useful life, please refer to the notes to the consolidated financial statements, 1 ‘Basic information and principles of the report – Main sources of estimation uncertainty’, 3 ‘Summary of significant accounting policies – Intangible assets and goodwill’ and 11 ‘Goodwill and intangible assets’ (tables). |

Impairment testing of goodwill and intangible assets with an indefinite useful life is based on a process defined by the Board of Directors, using the business plans approved by them. As part of this process, Management estimates the cash flows for the cash-generating units concerned. We assessed the identification of the relevant CGUs taking into account the IFRS accounting standards and our knowledge of the organisation, structure and management of the Group. We compared the business results of the year under review with the forecasts prepared in the prior year in order to identify any assumptions that in retrospect might appear too optimistic regarding the cash flows. The business results of the year under review slightly exceeded the budget. As in previous years, Management therefore based this year’s forecasts on the growth rates and margins used in the current business plan of the Geberit Group. We compared Management’s assumptions concerning long-term revenue growth and margin growth with industry growth forecasts and historical margins, as appropriate. We compared the discount rate with the cost of capital of the Group and of analogous firms. In addition, we performed a plausibility check on the forecasted change in net working capital. The assumptions used were consistent and in line with our expectations. We tested the sensitivity analyses of the key assumptions. These analyses enabled us to assess any potential impairment of goodwill or of intangible assets. Based on the evidence obtained from our audit, we consider the valuation method and the underlying assumptions to be an appropriate and adequate basis for the impairment testing of goodwill and of intangible assets with an indefinite useful life. |

Other information in the annual report

The Board of Directors is responsible for the other information in the annual report. The other information comprises all information included in the annual report, but does not include the consolidated financial statements, the stand-alone financial statements and the remuneration report of Geberit AG and our auditor’s reports thereon.Our opinion on the consolidated financial statements does not cover the other information in the annual report and we do not express any form of assurance conclusion thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other information in the annual report and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of this other information; we are required to report that fact. We have nothing to report in this regard.

Responsibilities of the Board of Directors for the consolidated financial statements

The Board of Directors is responsible for the preparation of the consolidated financial statements that give a true and fair view in accordance with IFRS and the provisions of Swiss law, and for such internal control as the Board of Directors determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.In preparing the consolidated financial statements, the Board of Directors is responsible for assessing the Group’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the Board of Directors intends either to liquidate the Group or to cease operations, or has no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the consolidated financial statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Swiss law, ISAs and Swiss Auditing Standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or taken together, they could reasonably be expected to influence the economic decisions of users taken based on these consolidated financial statements.As part of an audit in accordance with Swiss law, ISAs and Swiss Auditing Standards, we exercise professional judgement and maintain professional scepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group’s internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made.

- Conclude on the appropriateness of the Board of Directors’ use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Group to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

- Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the Group audit. We remain solely responsible for our audit opinion.

We communicate with the Board of Directors or its relevant committee regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide the Board of Directors or its relevant committee with a statement that we have complied with relevant ethical requirements regarding independence, and communicate to them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with the Board of Directors or its relevant committee, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

Report on other legal and regulatory requirements

In accordance with article 728a paragraph 1 item 3 CO and Swiss Auditing Standard 890, we confirm that an internal control system exists which has been designed for the preparation of consolidated financial statements according to the instructions of the Board of Directors.

We recommend that the consolidated financial statements submitted to you be approved.

PricewaterhouseCoopers AG

|

|

|

Beat Inauen Audit expert Auditor in charge |

Martin Knöpfel Audit expert |

St. Gallen, 8 March 2017